Save Your Money, Save the State: Keep the Kicker

By Eric Fruits, Ph.D. A few months ago, Oregonians learned they will be…

Read Blog Detail

By Eric Fruits, Ph.D. A few months ago, Oregonians learned they will be…

Read Blog Detail

By Eric Fruits, Ph.D. Apparently, “COVID time” is a real thing. A week…

Read Blog Detail

By Micah Perry At a time when many Portlanders are sleeping on sidewalks,…

Read Blog Detail

By Rachel Dawson Did you just have an order for a desktop computer…

Read Blog Detail

By Mia Tiwana Portland’s Harriet Tubman Middle School might be on the move….

Read Blog Detail

(Photo is a stock photo.) By Stew Robertson You would think Portland Parks…

Read Blog Detail

By Mia Tiwana If we want to continue seeing downtown Portland improve, maybe…

Read Blog Detail

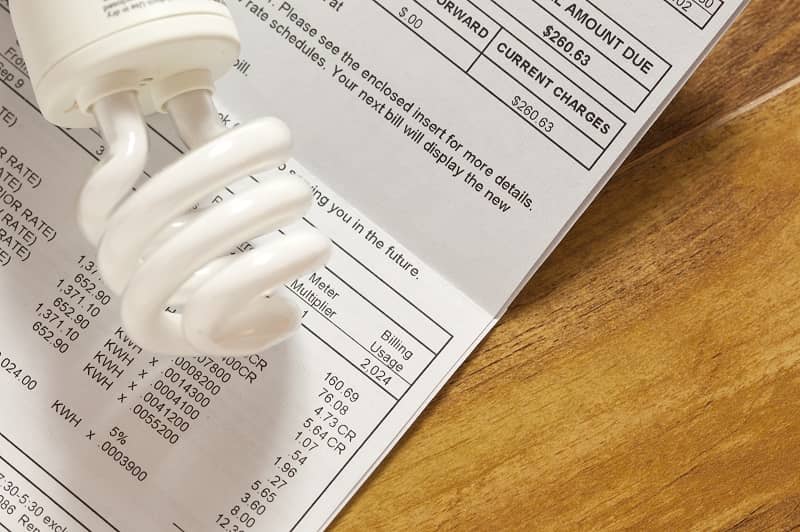

By Rachel Dawson Oregonians are struggling to pay their utility bills. So then…

Read Blog Detail

By Stew Robertson The City of Portland’s housing state of emergency, first declared…

Read Blog Detail

By Mia Tiwana Portland is on its way to having more than three…

Read Blog Detail

By Eric Fruits, Ph.D. Portland’s housing crisis is now in its sixth year….

Read Blog Detail

A proposed ordinance aims to deprioritize some homeless camps considered “low impact” By…

Read Blog Detail

By adopting a near-zero assumed rate of return, PERS can become solvent in…

Read Blog Detail

Portland’s policy of Inclusionary Zoning makes housing less affordable for families. By Vlad…

Read Blog Detail

By adopting a near-zero assumed rate of return, PERS can become solvent in…

Read Blog Detail

How the Housing First approach keeps failing to support homeless reentry into independent…

Read Blog Detail

By Vlad Yurlov The Portland region’s top homelessness officials delivered another set of…

Read Blog Detail

State spending per student in public school is $2,000 more than average private…

Read Blog Detail

By Vlad Yurlov Portland’s Lents neighborhood got a new homeless program in 2021….

Read Blog Detail

Chair Kafoury and Commissioners, Over the last year, the Joint Office of Homeless…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, a Craigslist post brought it home—we’re in…

Read Blog Detail

Doubling down on failing policy puts both homeless residents and taxpayers at risk…

Read Blog Detail

April 29, 2021 FOR IMMEDIATE RELEASE Cascade Policy Institute4850 SW Scholls Ferry Rd.,…

Read Blog Detail

Via Email April 29, 2021 Metro Council600 NE Grand Ave.Portland, OR 97232 Re: …

Read Blog Detail

FOR IMMEDIATE RELEASEApril 2, 2021 Cascade Policy Institute4850 SW Scholls Ferry Rd., Ste….

Read Blog Detail

Raising prevailing wages would burden taxpayers and marginalize minorities By Vlad Yurlov Bad…

Read Blog Detail

By John A. Charles, Jr. Last November, Oregon voters approved three ballot measures…

Read Blog Detail

By Vlad Yurlov It’s a bad sign when businesses need to fortify their…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, Oregon Attorney General Ellen Rosenblum’s office reached…

Read Blog Detail

By Vlad Yurlov and Eric Fruits, Ph.D. A recent Oregonian/OregonLive editorial criticizes Metro’s…

Read Blog Detail

By Vlad Yurlov Why is “affordable housing” so expensive? Many politicians, bureaucrats, and…

Read Blog Detail

By Rachel Dawson Oregon is home to NuScale Power, the nation’s leading small…

Read Blog Detail

By Kathryn Hickok and Helen Doran Every parent knows a solid education prepares…

Read Blog Detail

By Rachel Dawson Should governments use taxpayer dollars to support select companies of…

Read Blog Detail

By Vlad Yurlov If you thought hospital food was bland now, get ready…

Read Blog Detail

By Eric Fruits, Ph.D. Oregonians blame Californians for many of our state’s woes….

Read Blog Detail

By Vlad Yurlov Since 2015, Portland City Council has declared continuous housing emergencies….

Read Blog Detail

January 22, 2021 FOR IMMEDIATE RELEASE Media Contacts: Eric Fruits, Ph.D.Office: (503) 242-0900eric@cascadepolicy.org…

Read Blog Detail

Some straightforward solutions to a complex problem By Eric Fruits, Ph.D. and Vlad…

Read Blog Detail

By Helen Doran What does an old industrial site from World War II…

Read Blog Detail

By John A. Chalres. Jr. Every month when you pay your electricity bill,…

Read Blog Detail

By Rachel Dawson In the middle of a worldwide pandemic that has decimated…

Read Blog Detail

By Rachel Dawson Oregon couldn’t let a new year commence without the rollout…

Read Blog Detail

By Vlad Yurlov When businesses fail, they shut down. But when the government…

Read Blog Detail

By Eric Fruits, Ph.D. This year, Oregon passed a major milestone. In 2020,…

Read Blog Detail

Shelter space can be used effectively by tracking and reporting vacancies By Vlad…

Read Blog Detail

By Rachel Dawson As government-imposed shutdowns continue, more Oregonians are struggling to pay…

Read Blog Detail

By Eric Fruits, Ph.D. This week, the U.K. became the first western nation…

Read Blog Detail

By Rachel Dawson Do you want to enjoy a drink but don’t feel…

Read Blog Detail

John A. Charles, Jr.President & CEOCascade Policy InstituteNovember 29, 2020 Below is a…

Read Blog Detail

December 3, 2020 FOR IMMEDIATE RELEASE Media Contacts:John A. Charles, Jr.Office: (503) 242-0900Mobile:…

Read Blog Detail

By John A Charles, Jr. and Rachel Dawson EXECUTIVE SUMMARY The Oregon Public…

Read Blog Detail

By Eric Fruits. Ph.D. Winter is coming to Oregon, and it might be…

Read Blog Detail

Voters approve Measure 110, decriminalizing drugs while creating an unaccountable bureaucracy By Eric…

Read Blog Detail

By Vlad Yurlov While many people in the Portland region value efficient governments,…

Read Blog Detail

Metro’s Transportation Tax Will Overspend on Underused Projects By Rachel Dawson and Vlad…

Read Blog Detail

Cascade Policy Institute urges Metro Auditor and the Oregon Secretary of State to…

Read Blog Detail

By Vlad Yurlov On October 2, Helping Hands unveiled its latest transitional housing…

Read Blog Detail

October 4, 2020 FOR IMMEDIATE RELEASE Media Contact: Eric Fruits, Ph.D. (503) 242-0900…

Read Blog Detail

The regional government plans to borrow money to implement its new income taxes…

Read Blog Detail

By Vlad Yurlov Metro is expected to spend over $1.4 billion this fiscal…

Read Blog Detail

By Eric Fruits, Ph.D. President Trump is frequently accused of lying. But he…

Read Blog Detail

Oregon’s Business Community Is Challenging the $7.8 Billion Measure By Vlad Yurlov After…

Read Blog Detail

By Cooper Conway Joe Rogan, the outspoken commenter, comedian, and host, announced on…

Read Blog Detail

By Eric Fruits, Ph.D. On July 24th, the New York Times ran a…

Read Blog Detail

By Helen Doran A scenic drive through the country does not usually call…

Read Blog Detail

By Rachel Dawson Based on the passage of a 10% cap on commission…

Read Blog Detail

By Rachel Dawson After 42 years, the Public Utility Regulatory Policies Act (PURPA)…

Read Blog Detail

By Eric Fruits, Ph.D. While much of the region is stuck at home…

Read Blog Detail

By Helen Cook On June 25th, Metro approved $700,000 in taxpayer money for…

Read Blog Detail

By Rachel Dawson Governor Kate Brown took carbon policy into her own hands…

Read Blog Detail

By Eric Fruits, Ph.D. The 2020 we’re living in is very different from…

Read Blog Detail

By Rachel Dawson You may have noticed companies and public agencies using the…

Read Blog Detail

By Rachel Dawson Metro has a history of breaking promises to voters. This…

Read Blog Detail

By Eric Fruits, Ph.D. Many Oregon businesses are looking forward toward May 15….

Read Blog Detail

By Eric Fruits, Ph.D. Many Oregon businesses are looking forward toward May 15….

Read Blog Detail

By Eric Fruits, Ph.D. Does Metro’s appetite for more money ever end? Last…

Read Blog Detail

By Eric Fruits, Ph.D. We all need to raise questions about our politicians’…

Read Blog Detail

By Eric Fruits, Ph.D. This May, Portland voters will be asked to renew…

Read Blog Detail

By Rachel Dawson The Oregon nonprofit Cascadia Clusters understands the value of providing…

Read Blog Detail

By Eric Fruits, Ph.D. Coronavirus has hit the economy hard. Nearly all the…

Read Blog Detail

By Rachel Dawson Businesses across Oregon are laying off employees and shuttering their…

Read Blog Detail

By Eric Fruits, Ph.D. The coronavirus is already taking a toll on our…

Read Blog Detail

By Eric Fruits, Ph.D. At the first—and likely only—public hearing on Metro’s “supportive…

Read Blog Detail

By Miranda Bonifield You may not be able to tax carbon out of…

Read Blog Detail

By Eric Fruits, Ph.D. With this year’s “short” session of the legislature, the…

Read Blog Detail

By Rachel Dawson Oregon state officials recently celebrated helping the state reach 25,000…

Read Blog Detail

By Katie Eyre, CPA The 2019 Oregon Legislature established a new tax affecting…

Read Blog Detail

By Eric Fruits, Ph.D. Oregon is less than three months away from the…

Read Blog Detail

By Helen Cook Oregon has a booming craft distilling industry. That’s why it’s…

Read Blog Detail

How much would you be willing to spend to buy parkland that would…

Read Blog Detail

Cascade Policy Institute Urges a NO Vote on Measure 26-203 Voters should reject…

Read Blog Detail

By John A. Charles, Jr. In 2016 Val Hoyle, then a legislator from…

Read Blog Detail

By Rachel Dawson Portland’s temporary gas tax should stay just that: temporary. Portland…

Read Blog Detail

By Eric Fruits, Ph.D. What if the self-proclaimed “City that Works” isn’t working?…

Read Blog Detail

By Micah Perry On Wednesday, August 7, 2019, the Portland City Council passed…

Read Blog Detail

By Rachel Dawson Milton Friedman once famously said that “nothing is more permanent…

Read Blog Detail

By Micah Perry The Portland City Council recently passed a new ordinance that…

Read Blog Detail

By Helen Cook How much would you be willing to pay in taxes…

Read Blog Detail

By Rachel Dawson In January 2019 the City of Portland implemented a voter-approved…

Read Blog Detail