Oregon’s Reliance on Fossil Fuels Is Growing, Not Shrinking

By John A. Charles, Jr. During the holidays, the Oregon Department of Energy…

Read Blog Detail

By John A. Charles, Jr. During the holidays, the Oregon Department of Energy…

Read Blog Detail

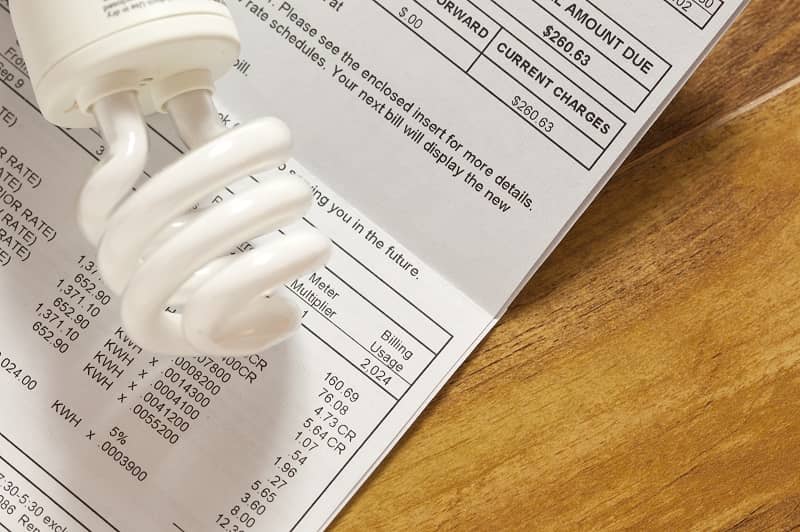

By Rachel Dawson Oregonians are struggling to pay their utility bills. So then…

Read Blog Detail

By Rachel Dawson As government-imposed shutdowns continue, more Oregonians are struggling to pay…

Read Blog Detail

By Rachel Dawson On Thursday, October 15, Portland General Electric pulled the plug…

Read Blog Detail

October 19, 2020 FOR IMMEDIATE RELEASE Media Contact: Rachel Dawson (503) 242-0900 rachel@cascadepolicy.org…

Read Blog Detail

By Rachel Dawson Oregon, it’s about time we talk about nuclear power. No,…

Read Blog Detail

By Rachel Dawson TriMet unveiled five new battery-electric buses (BEBs) in April 2019,…

Read Blog Detail