Oregon’s Last Mask Mandate Has Been Lifted, But State Policy Guarantees More Lockdowns in the Next Pandemic

By Eric Fruits, Ph.D. Earlier this month, Oregon lifted its mask mandate for…

Read Blog Detail

By Eric Fruits, Ph.D. Earlier this month, Oregon lifted its mask mandate for…

Read Blog Detail

Chair Kafoury and Commissioners, Over the last year, the Joint Office of Homeless…

Read Blog Detail

By Eric Fruits, Ph.D. With the clock ticking down to midnight on December…

Read Blog Detail

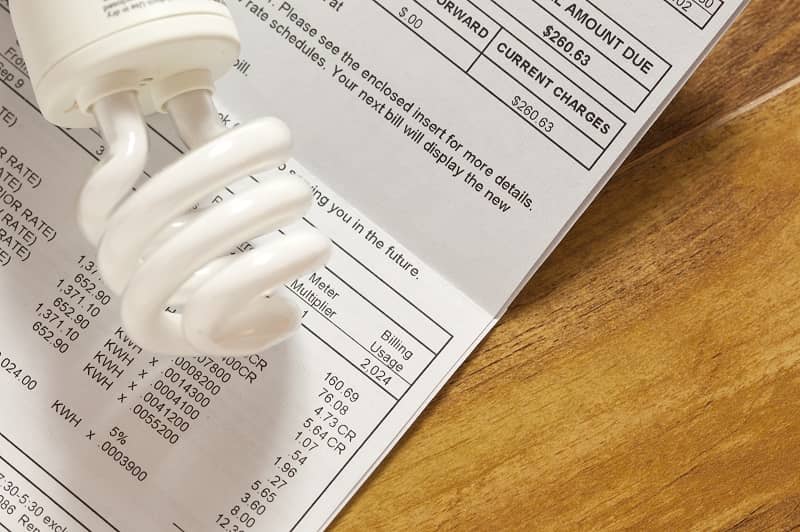

By Rachel Dawson As government-imposed shutdowns continue, more Oregonians are struggling to pay…

Read Blog Detail

By Eric Fruits, Ph.D. This week, the U.K. became the first western nation…

Read Blog Detail

By Rachel Dawson Do you want to enjoy a drink but don’t feel…

Read Blog Detail

By Helen Doran “What is going on?” That’s what many Oregon parents are…

Read Blog Detail

By Eric Fruits, Ph.D. On September 21, 2020, Oregon’s Senate heard policy proposals…

Read Blog Detail

By Helen Doran Oregon guidelines for the 2020 fall semester have been remarkably…

Read Blog Detail

By Cooper Conway The Oregon Education Association (OEA) recently penned a letter to legislators urging…

Read Blog Detail

By Vlad Yurlov Alcohol-lovers may have a reason for a toast. Oregon’s Liquor…

Read Blog Detail

By Rachel Dawson When it comes to commuting during COVID-19, private vehicles are…

Read Blog Detail

By Eric Fruits, Ph.D. The COVID-19 pandemic has wrecked state and local budgets….

Read Blog Detail

By Eric Fruits, Ph.D. Many Oregon businesses are looking forward toward May 15….

Read Blog Detail

By Eric Fruits, Ph.D. Many Oregon businesses are looking forward toward May 15….

Read Blog Detail

By Eric Fruits, Ph.D. Does Metro’s appetite for more money ever end? Last…

Read Blog Detail

By Eric Fruits, Ph.D. Oregon is nearing the end of the first month…

Read Blog Detail

By Rachel Dawson “The vast disparity between the rich and the poor is,…

Read Blog Detail

By Rachel Dawson Businesses across Oregon are laying off employees and shuttering their…

Read Blog Detail

By Eric Fruits, Ph.D. The coronavirus is already taking a toll on our…

Read Blog Detail