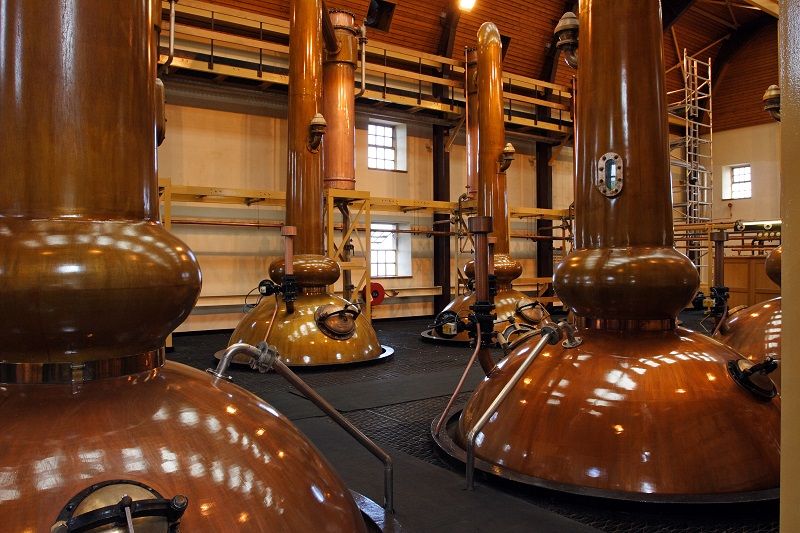

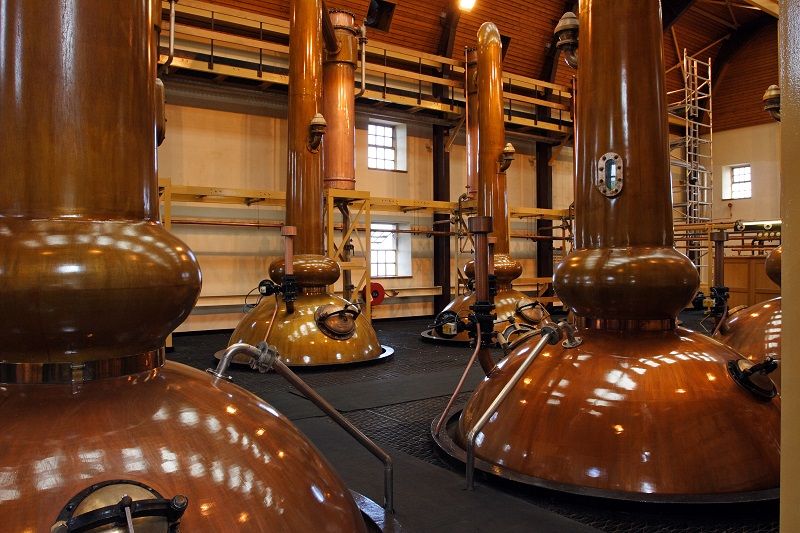

Oregon Distilleries Deserve Better

By Helen Cook Oregon has a booming craft distilling industry. That’s why it’s…

Read Blog Detail

By Helen Cook Oregon has a booming craft distilling industry. That’s why it’s…

Read Blog Detail

By Helen Cook How much would you be willing to pay in taxes…

Read Blog Detail