3 Ways Oregon Legislators Can Expand Options for K-12 Students Today

By Kathryn Hickok January 22-28 is National School Choice Week, a celebration of…

Read Blog Detail

By Kathryn Hickok January 22-28 is National School Choice Week, a celebration of…

Read Blog Detail

By John A. Charles, Jr. On December 19, Oregon’s Environmental Quality Commission voted…

Read Blog Detail

By Eric Fruits, Ph.D. My, how time flies. Just last month, I warned…

Read Blog Detail

Comments from Cascade Policy InstituteEric Fruits, Ph.D., Vice President of Research Oregon Department…

Read Blog Detail

By Eric Fruits, Ph.D. “We got a full tank of gas, half a…

Read Blog Detail

By Eric Fruits, Ph.D. With 2022 winding down and 2023 less than a…

Read Blog Detail

By Eric Fruits, Ph.D. ‘Tis the season for holiday wishes. And, toward that…

Read Blog Detail

By Eric Fruits, Ph.D. Critics of education savings accounts, or ESAs, claim that…

Read Blog Detail

By Eric Fruits, Ph.D. Critics of education savings accounts, or ESAs, claim ESA…

Read Blog Detail

By Eric Fruits, Ph.D. Vouchers and education savings accounts (ESAs) are a subset…

Read Blog Detail

By Eric Fruits, Ph.D. In recent years, school vouchers and education savings accounts…

Read Blog Detail

Download the full PDF here

Read Blog Detail

Cascade Policy Institute 4850 SW Scholls Ferry Road, #103 Portland, OR 97225 December…

Read Blog Detail

By Eric Fruits, Ph.D. If the Oregon Department of Transportation has its way,…

Read Blog Detail

Testimony of Cascade Policy Institute Multnomah County Board of CommissionersAgenda Item PH.1 Agenda…

Read Blog Detail

Comments from Cascade Policy Institute Eric Fruits, Ph.D.[1] November 16, 2022 Cascade Policy…

Read Blog Detail

By Eric Fruits, Ph.D. First they banned styrofoam, then last week they banned…

Read Blog Detail

By Kathryn Hickok This year, Arizona became the first state to expand eligibility…

Read Blog Detail

By James Swyter Today, many people associate the word “monopoly” with big tech…

Read Blog Detail

By Eric Fruits, Ph.D. This Thanksgiving let’s give thanks to the Pilgrims who…

Read Blog Detail

By Kathryn Hickok A June poll of Oregonians conducted by Nelson Research and…

Read Blog Detail

By Eric Fruits, Ph.D. Portland is a world leader in magical thinking on…

Read Blog Detail

By Eric Fruits, Ph.D. It’s the day after Election Day and the votes…

Read Blog Detail

By Eric Fruits, Ph.D “What’s the one thing you’d do to fix Oregon?”…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, Portland Mayor Ted Wheeler and his council…

Read Blog Detail

By Eric Fruits, Ph.D. This week, Portland City Council is considering five resolutions…

Read Blog Detail

By Eric Fruits, Ph.D. Yet again, Metro is asking for more money for…

Read Blog Detail

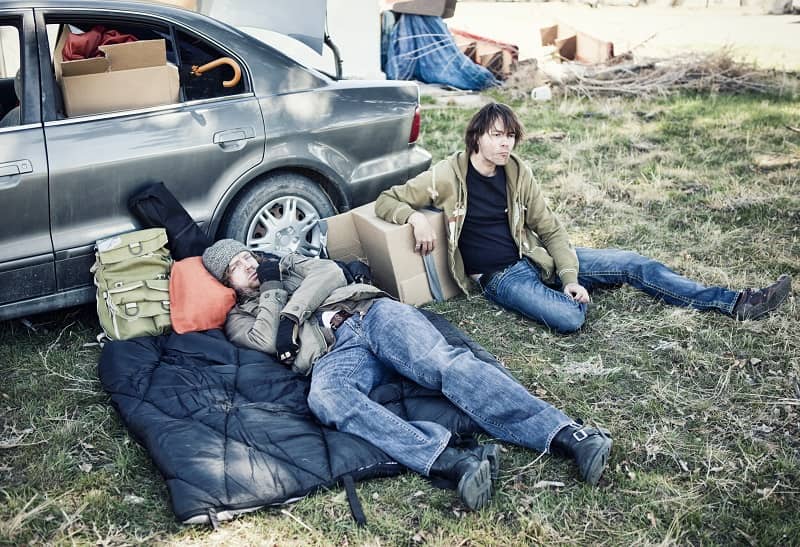

By Eric Fruits, Ph.D. For most of us, homeless tents blocking sidewalks are…

Read Blog Detail

By Eric Fruits, Ph.D. This week, ballots for the November election will be…

Read Blog Detail

By Eric Fruits, Ph.D. In just a few weeks, Oregon voters will be…

Read Blog Detail

By James Swyter For years, policymakers in Oregon have wrung their hands over…

Read Blog Detail

By John A. Charles, Jr. The Oregon Department of Environmental Quality is accepting…

Read Blog Detail

By Kathryn Hickok The Heritage Foundation recently released its first Education Freedom Report…

Read Blog Detail

By Kathryn Hickok This summer, Arizona expanded the nation’s first Education Savings Account…

Read Blog Detail

By Eric Fruits, Ph.D. The ballot for November’s election is filling up, and…

Read Blog Detail

By Kathryn Hickok Oregon soon will have a new governor and a new…

Read Blog Detail

By Eric Fruits, Ph.D. By now you’ve heard of President Biden’s student loan…

Read Blog Detail

By Eric Fruits, Ph.D. If you feel like Oregon politicians are spending more,…

Read Blog Detail

By Eric Fruits, Ph.D. It seems everywhere you look, “clean energy” is in…

Read Blog Detail

By James Swyter In less than two weeks, Oregon students will be heading…

Read Blog Detail

By Eric Fruits, Ph.D. It seems everywhere you look, “clean energy” is in…

Read Blog Detail

By Taylor Marks In 2014, Fire Station 21, located on SE Madison St….

Read Blog Detail

By Mia Tiwana Connecticut’s bus service just pulled its entire fleet of electric…

Read Blog Detail

By James Swyter and Mia Tiwana This month, Portland City Council approved $118…

Read Blog Detail

By Eric Fruits, Ph.D. Things are not going well in the Portland region….

Read Blog Detail

Download the full PDF here

Read Blog Detail

By Mia Tiwana Have you heard of the Portland Clean Energy Fund? Portlanders…

Read Blog Detail

By Eric Fruits, Ph.D. Two of my kids are young adults working retail….

Read Blog Detail

By Taylor Marks Too much, all at once. Portland’s city charter is long…

Read Blog Detail

By Eric Fruits, Ph.D. Last week, an Oregonian story reported that for years,…

Read Blog Detail

Projected spending for the Center for Black Student Excellence may violate Oregon Law…

Read Blog Detail

By Mia Tiwana Portland City Council is trying its best to bring electric…

Read Blog Detail

By Taylor Marks Starting July 1, Portland property owners will have new choices…

Read Blog Detail

By Eric Fruits, Ph.D. It’s budget season for local governments in Oregon. Budgets…

Read Blog Detail

By Mia Tiwana This year, Portland Public Schools is in a financial sweet…

Read Blog Detail

By Eric Fruits, Ph.D. Are you ready to pay a toll to cross…

Read Blog Detail

By Taylor Marks Over-promised and under-delivered. Throughout its 18-year life, TriMet’s Yellow Line…

Read Blog Detail

May 24, 2022 FOR IMMEDIATE RELEASE Media Contacts: Eric Fruits, Ph.D.Office: (503) 242-0900eric@cascadepolicy.org…

Read Blog Detail

By Eric Fruits, Ph.D. and Mia Tiwana Executive Summary In November 2020, Portland…

Read Blog Detail

May 19, 2022 FOR IMMEDIATE RELEASE Media Contacts:Micah PerryOffice: (503) 242-0900Mobile: (303) 330-3855micah@cascadepolicy.org…

Read Blog Detail

By Eric Fruits, Ph.D. By the time you’re reading this, your May primary…

Read Blog Detail

By John A. Charles, Jr. State Representatives Karin Power (Milwaukie), Anna Williams (Hood…

Read Blog Detail

By Micah Perry According to a revised report from economic consulting firm ECONorthwest,…

Read Blog Detail

By Eric Fruits, Ph.D. Next week is National Charter Schools Week. Oregon passed…

Read Blog Detail

By Eric Fruits, Ph.D. For more than a year, Cascade Policy Institute has…

Read Blog Detail

By Kathryn Hickok The last two years have made it clear: Oregon parents…

Read Blog Detail

By Micah Perry For years, Portland residents have dealt with homeless individuals parking…

Read Blog Detail

By Micah Perry The Oregon Transportation Commission recently decided how to allocate $412…

Read Blog Detail

By Eric Fruits, Ph.D. The Census just released the latest population estimates and,…

Read Blog Detail

By John A. Charles, Jr. Many Oregon politicians have convinced themselves that we…

Read Blog Detail

By Eric Fruits, Ph.D. This time they’re coming for your home. Earlier this…

Read Blog Detail

Download full PDF here

Read Blog Detail

By Micah Perry According to a new survey from the Oregon Values and…

Read Blog Detail

By Eric Fruits, Ph.D. Just five months ago, Portland City Council announced that…

Read Blog Detail

By Micah Perry Everyone loves getting a raise. Our Oregon state legislators are…

Read Blog Detail

By John A. Charles, Jr. March 1, 2022Rosanne Powell, Senior Board ManagerPortland Public…

Read Blog Detail

February 24, 2022 Senate Committee on EducationOregon State Legislature Re: Support for SB…

Read Blog Detail

By Eric Fruits, Ph.D. People in the Portland area love their parks and…

Read Blog Detail

By Rachel Dawson Think the natural gas industry is dying? The latest data…

Read Blog Detail

By Eric Fruits, Ph.D. Why does Oregon still have a mask mandate? Oregon…

Read Blog Detail

By Eric Fruits, Ph.D. Public meetings can be boring, but those meetings are…

Read Blog Detail

By Micah Perry Land use regulations in Oregon are adversely impacting the state’s…

Read Blog Detail

He Had the Right Approach on Homelessness By Eric Fruits, Ph.D. Fewer than…

Read Blog Detail

By John A. Charles, Jr. February 3, 2022Senate Natural Resources CommitteeState CapitolSalem, OR…

Read Blog Detail

By Rachel Dawson A recent poll by the Portland Business Alliance found that…

Read Blog Detail

By Micah Perry In December 2021, Metro, the Portland-area regional government, opened Newell…

Read Blog Detail

By Kathryn Hickok Oregon students are now half-way through their third school year…

Read Blog Detail

By Kathryn Hickok January 23-29 is National School Choice Week, a 50-state celebration…

Read Blog Detail

By Eric Fruits, Ph.D. COVID-19 disrupted—and may continue to disrupt—in-person learning at many…

Read Blog Detail

By Eric Fruits, Ph.D. Earlier this week, the Michigan Democratic Party’s Facebook account…

Read Blog Detail

By Rachel Dawson With the start of a new year, power customers will…

Read Blog Detail

By Eric Fruits, Ph.D. Just after dinner on New Year’s Eve, my oldest…

Read Blog Detail

By Eric Fruits, Ph.D. As 2021 is wrapping up, it turns out that…

Read Blog Detail

By Rachel Dawson Nearly a year after Oregon’s drug decriminalization experiment began, results…

Read Blog Detail

By Eric Fruits, Ph.D. What if everything we thought we knew about homelessness…

Read Blog Detail

By Eric Fruits, Ph.D. If you guessed that Oregonians think homelessness is the…

Read Blog Detail

By John A. Charles, Jr. Testimony of John A. Charles, Cascade Policy InstituteBefore…

Read Blog Detail

By Rachel Dawson The era of small-modular nuclear reactors (SMRs) is upon us,…

Read Blog Detail

By Micah Perry It’s been more than six years since Portland declared a…

Read Blog Detail

By Eric Fruits, Ph.D. Last month, the Oregonian excitedly reported some great news:…

Read Blog Detail