In a misguided attempt to save us from ourselves, Oregon legislators have become addicted to the so-called sin taxes they place on booze, drugs, and gambling. If we don’t break their addiction, it will expand into areas such as sugary soft drinks and fatty foods.

Now, a provocative new study challenges the whole concept of sin taxes, finding that they “not only do little to limit the use of ‘bad’ products, they do nothing to reduce societal costs.” Most remarkably, the study “demonstrates that those shockingly large estimates of the costs that the consumption of alcohol, tobacco, sugar, and fat supposedly impose on society have little basis in reality.”

Sin taxes also hit the poor harder than the rich. That’s because products like tobacco and state lotteries are disproportionately purchased by lower income people.

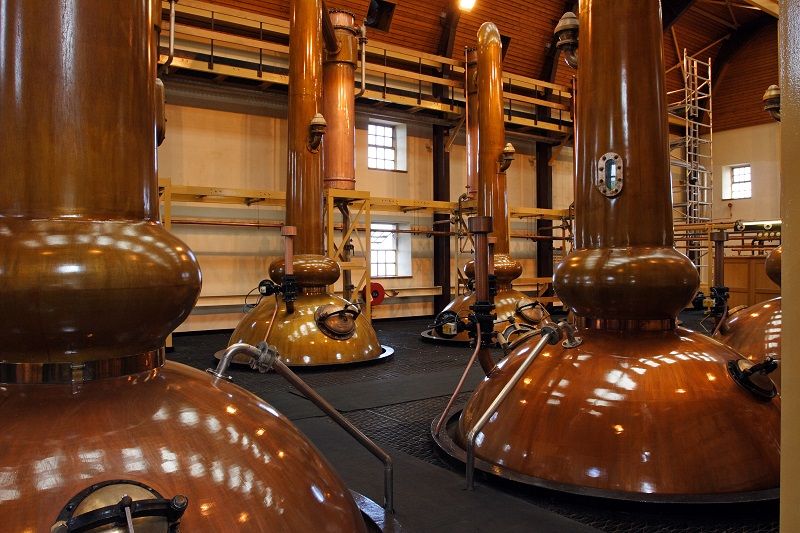

Sin taxes also give governments “a financial incentive to foster the very vices they profess to despise.” This may explain why, out of the more than one billion dollars Oregon has received to date from the Tobacco Master Settlement Agreement between 46 states and the tobacco companies, “not one penny has gone to tobacco prevention.” Prevention would cut into the state’s lucrative tobacco tax revenue, just as it would cut into state monopoly liquor revenue. The same goes for the state lottery that supposedly does good things at the expense of addicted gamblers.

It’s time that Oregon break its addiction to sin taxes.

Steve Buckstein is founder and Senior Policy Analyst at Cascade Policy Institute, Oregon’s free market public policy research organization.