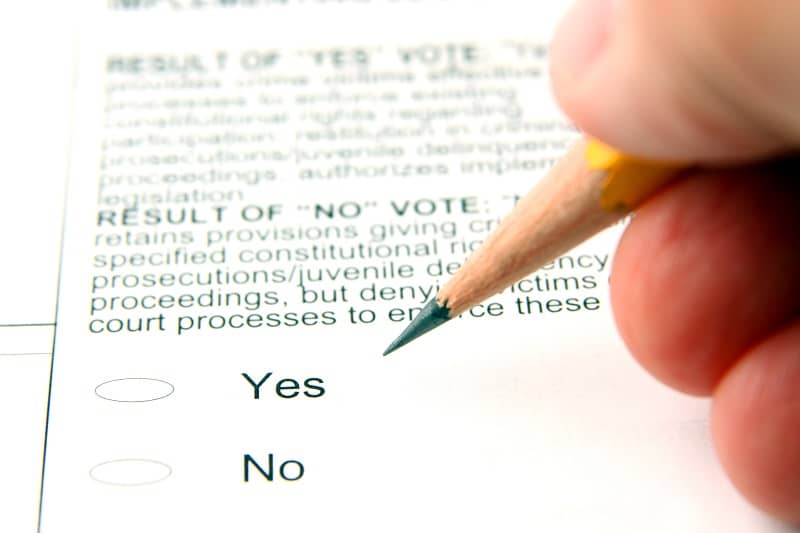

Multnomah County voters just approved Oregon’s only local income tax, primarily to help schools. The 1.25 percent three-year tax is on top of Oregon’s already high 9 percent state income tax. Voters clearly value education, but this new money will largely benefit the teachers’ union, not the students. Rather than help the schools in a positive way, the new tax will allow the school system to avoid doing two things it must eventually do: control spending and become accountable for learning outcomes.

First, supporters of the new tax failed to recognize that school districts don’t have a budget shortfall so much as they have a spending problem. Giving districts more money will do nothing to correct their spending behavior. The Portland district, for example, had a real opportunity to curb out-of-control benefit costs during contract negotiations earlier this year. However, once the measure was proposed by Portland’s Mayor and Multnomah County’s Chairwoman, the school district board caved in and gave the teachers’ union virtually everything it wanted.

Second, with the passage of Measure 26-48, the teachers union got its wish: ever increasing funding without any connection to student learning. While audits may ensure that this new money goes into the classroom, nothing will stop existing school funds from flowing into administration or ever-growing employee benefits. The new tax is all about inputs. There is no accountability for learning outcomes.

So, voters did more than give the school system a new source of revenue. They rejected the opportunity to rein in costs and make the system accountable for student learning. Once again, the adults in the system came out winners, and the students came out losers.

© 2006, Cascade Policy Institute. All rights reserved. Permission to reprint in whole or in part is hereby granted, provided the author and Cascade Policy Institute are cited. Contact Cascade at (503) 242-0900 to arrange print or broadcast interviews on this topic. For more topics visit the QuickPoint! archive.